Forex Brokers: Premier Systems for Trading Success

Forex Brokers: Premier Systems for Trading Success

Blog Article

Decoding the Globe of Foreign Exchange Trading: Revealing the Importance of Brokers in Managing Risks and Making Sure Success

In the intricate realm of foreign exchange trading, the duty of brokers stands as a crucial component that commonly continues to be shrouded in mystery to numerous ambitious traders. The relevance of brokers exceeds plain purchase assistance; it includes the world of danger administration and the total success of trading endeavors. By handing over brokers with the task of navigating the intricacies of the forex market, investors can potentially unlock a world of chances that might or else remain evasive. The detailed dance between investors and brokers introduces a symbiotic connection that holds the crucial to unraveling the enigmas of rewarding trading endeavors.

The Duty of Brokers in Foreign Exchange Trading

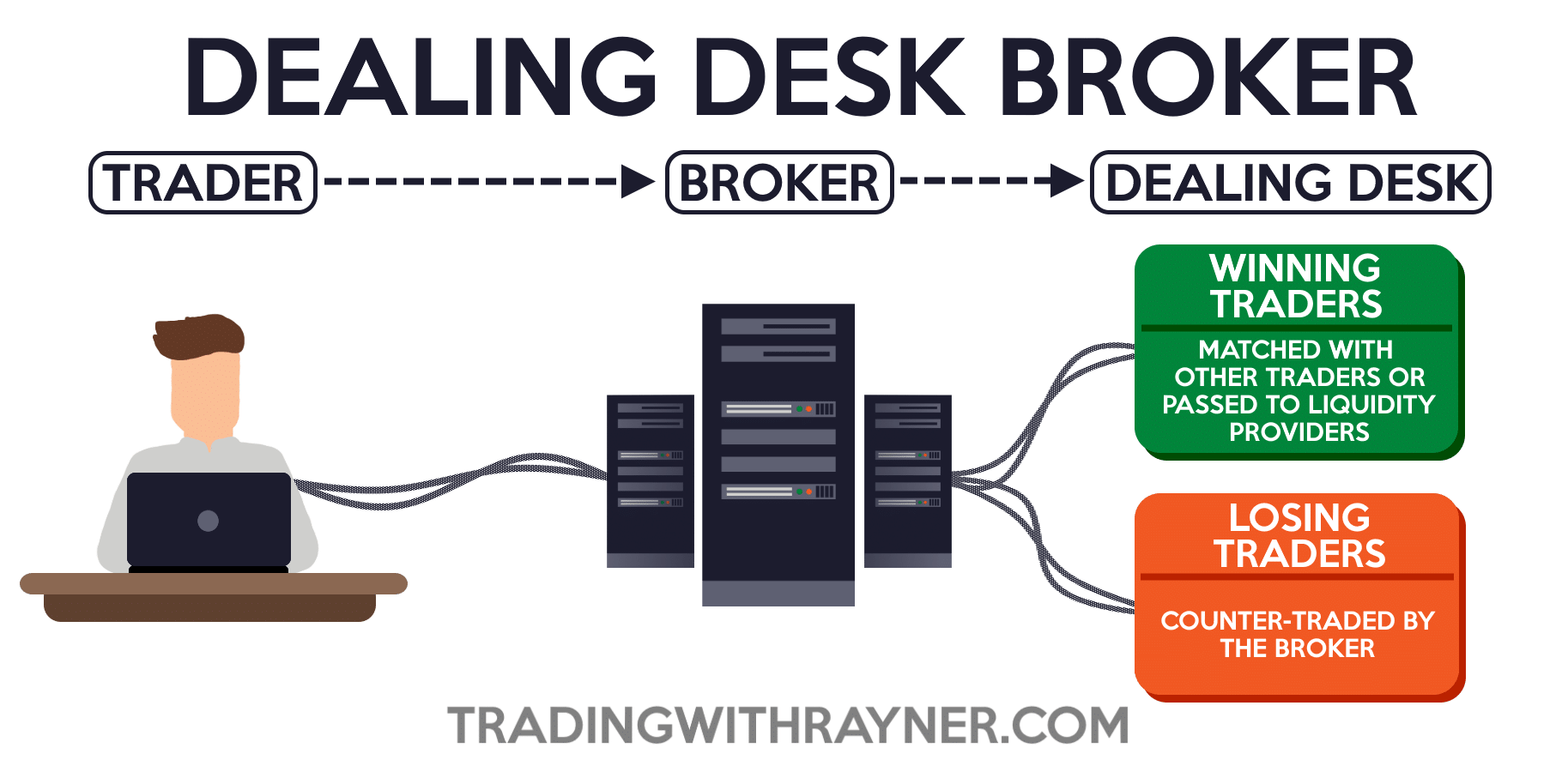

Brokers play a vital duty in forex trading by giving crucial services that assist investors take care of risks successfully. These monetary intermediaries work as a bridge between the investors and the forex market, supplying a variety of services that are crucial for navigating the complexities of the forex market. One of the primary features of brokers is to offer investors with access to the marketplace by helping with the implementation of professions. They provide trading platforms that permit investors to deal money pairs, offering real-time market quotes and making certain swift order implementation.

In addition, brokers offer educational resources and market analysis to help investors make notified choices and create effective trading strategies. On the whole, brokers are essential companions for investors looking to navigate the foreign exchange market efficiently and take care of threats properly.

Risk Administration Approaches With Brokers

Given the important duty brokers play in helping with accessibility to the international exchange market and giving risk management tools, comprehending efficient methods for taking care of threats with brokers is vital for effective foreign exchange trading. One key method is establishing stop-loss orders, which allow investors to determine the optimum amount they agree to lose on a profession. This tool aids restrict prospective losses and protects versus damaging market motions. Another crucial danger management technique is diversity. By spreading financial investments across various money pairs and asset classes, traders can minimize their direct exposure to any single market or instrument. In addition, using leverage carefully is vital for risk management. While leverage enhances profits, it likewise multiplies losses, so it is important to make use of leverage sensibly and have a clear understanding of its ramifications. Last but not least, maintaining a trading journal to track performance, evaluate past trades, and determine patterns can assist investors improve their strategies and make more educated decisions, eventually boosting threat management techniques in foreign exchange trading.

Broker Option for Trading Success

Selecting the appropriate broker is paramount for attaining success in forex trading, as it can dramatically influence the total trading experience and outcomes. Functioning with a managed broker supplies a layer of safety for investors, as it makes certain that the broker operates within set standards and criteria, thus decreasing the danger of fraud or negligence.

Furthermore, traders must analyze the broker's trading system and devices. Examining the broker's customer support services is vital.

Furthermore, investors must examine the broker's charge structure, consisting of spreads, commissions, and any kind of covert charges, to understand the cost implications of trading with a specific broker - forex brokers. By carefully reviewing these factors, traders can pick a broker that aligns with their trading website link objectives and establishes the phase for trading success

Leveraging Broker Expertise commercial

Exactly how can traders effectively harness the proficiency of their selected brokers to make best use of profitability in forex trading? Leveraging broker expertise for profit calls for a tactical method that includes understanding and making use of the services used by the broker to enhance trading end results.

Developing an excellent relationship with a broker can lead to personalized guidance, trade referrals, and danger management methods tailored to individual trading designs and goals. By connecting on a regular basis with their brokers and looking for input on trading strategies, traders can tap into skilled understanding and boost their general efficiency in the foreign exchange market.

Broker Support in Market Evaluation

Furthermore, brokers can give timely updates on financial events, geopolitical growths, and other factors that may impact currency rates, allowing investors to stay ahead of market fluctuations and readjust their trading positions appropriately. Inevitably, by utilizing broker help in market evaluation, traders can improve their this page trading efficiency and enhance their opportunities of success in the competitive foreign exchange market.

Verdict

Finally, brokers play a critical function in foreign exchange trading by handling risks, giving proficiency, and aiding in market analysis. Picking the best broker is essential for trading success and leveraging their expertise can result in earnings. forex brokers. By using risk administration techniques and functioning closely with brokers, investors can browse the complex globe of foreign exchange trading with confidence and raise their chances of success

Provided the important role brokers play in helping with access to the international exchange market and providing danger monitoring tools, comprehending effective strategies for managing dangers with brokers is essential for effective forex trading.Picking the best broker is vital for achieving success in foreign exchange trading, as it can considerably impact the total trading experience and outcomes. Working with a regulated broker supplies a layer of protection for investors, as it ensures that the broker operates within set requirements and guidelines, therefore lowering the threat of fraud or malpractice.

Leveraging broker proficiency for revenue requires a critical method that includes understanding and making use of the solutions supplied by the broker to enhance trading outcomes.To successfully take advantage of on broker competence for earnings in forex trading, traders can rely on broker assistance in market analysis for notified decision-making and risk reduction approaches.

Report this page